Binance

Buy & sell Crypto in minutes

Pros

-

Over 65 tradable cryptocurrencies for U.S. customers

-

Low fees

-

Wide selection of trading options and order types

cons

-

U.S. version is more limited

-

The platform is complex and may be confusing

-

No built-in digital wallet available

-

Binance has run into regulatory trouble in several countries

Introduction

Binance is the largest cryptocurrency trading platform in the world.1 Because it offers a robust selection of trading options and features, it is not particularly user-friendly. Investors may experience a steep learning curve with Binance depending on their experience and knowledge.

Through its desktop or mobile dashboards, Binance offers a wide array of trading features, including an impressive selection of market charts and hundreds of cryptocurrencies. Users can also access a variety of trading options including futures and options, as well as several order types.

However, many options and features are not available in the United States and only 65+ of the cryptocurrencies are accessible to U.S. customers.

In addition to its tools and features, Binance also offers a comprehensive learning platform, an NFT platform, and more. The NFT marketplace doesn't appear to be available to U.S. customers yet.

Crypto Exchange Details

- Minimum Trade Size: $10

- Maximum Leverage: 20x

- Minimum to Open Live: $10

- Established: 2017

- Cryptocurrencies: Dash (DASH), Cosmos (ATOM), Compound (COMP), Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Cardano (ADA)

- P2P Service : Yes

- Yield-Farming: $ 0.0000716

- Payment Option: 300 payment methods, including debit card, credit card and in-person cash payments, bank transfer

- Web Trading: Yes

- Mobile Trading: Yes

- Social Trading: Yes

- Restricted Countries:

- Collateral: Yes

- Staking: Yes

- Auto-Invest: Yes

- Deposit

Methods:

Bank transfers, Credit and debit cards, Cash balance and wallet options

- Withdrawal

Methods:

BTC, BNB, BUSD, ETH, ADA, ATOM, AVA, BCH, BIDR, CHR, CTSI, DAI, DASH, DOGE, DOT, EGLD, EOS, ETC, FIL, FRONT, FTM, GRS, HBAR, IOTX, LINK, LTC, MANA, MATIC, NEO, OM, ONE, PAX, QTUM, SLP, STRAX, SUPER, SXP, TKO, TRX, TUSD, UNI, USDC, USDT, VAI, VET, WRX, XLM, XMR, XRP, XTZ, XVG, XVS, ZEC, and ZIL.

Cryptocurrencies

Binance has more than 365 cryptocurrencies available for trade on its exchange, but only 65+ are available in the U.S. For international users, it also supports a variety of fiat currencies, including USD, EUR, AUD, GBP, HKD, and INR. Depending on your location, Binance has a wide variety of cryptocurrency pairs depending on your location.

Some of the cryptocurrencies available on Binance U.S. are: Binance Coin (BNB), VeChain (VET), Harmony (ONE), VeThor Token (VTHO), Dogecoin (DOGE), and Matic Network (MATIC). Additionally, Binance supports popular cryptocurrencies including:

- Dash (DASH)

- Cosmos (ATOM)

- Compound (COMP)

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Cardano (ADA)

Trading Experience

Binance offers a variety of trading tools, including real-time charting tools with moving averages and exponential moving averages. Users can place trades through the Binance app, Binance website, or Binance desktop app.

Traders can also use the Binance platform to access their portfolios and trade history, as well as view the order book and price charts. Additionally, Binance provides various order types such as stop order, limit order, stop-limit order, stop-market order, and trailing stop order. You can also choose different trading views ranging from classic to margin and OTC views. However, many of these features are unavailable in the U.S. including margin trading and some of the order types.

*Binance doesn’t have its own dedicated crypto wallet, but it recommends Trust Wallet. Generally, a crypto wallet is a relatively secure place to store your assets.

Products

With the broad range of crypto derivative instruments on offer, Binance Futures also provides investors and traders numerous ways to enter the market.

Altogether, Binance Futures offers access to four product lines:

- USDⓈ-Margined Futures Contracts - Supports perpetual and delivery contracts and settled in USDT or BUSD.

- Coin-Margined Futures Contracts - Supports perpetual and delivery contracts and is settled in cryptocurrency.

- Binance Leveraged Tokens - An innovative product that allows users to gain increased exposure to a specific crypto asset without worrying about liquidation risk.

- Binance Options - It simplifies options trading for retail users. With the built-in leverage offered, users can maximize profits while minimizing downside risk.

Features:

- Cross collateral - an innovative feature that allows users to collateralize their crypto assets to borrow against another crypto asset.

- Leaderboard - a fusion of social networking and cryptocurrency trading that allows users to view and follow the positions of the best traders on the platform.

- Battle - gamification of cryptocurrency trading by placing traders head to head in a battle to see who is the most profitable over a certain period.

Fees

Binance’s fees are among the lowest in the industry. While U.S.-based users will pay slightly more on Binance.us, its fees are still lower than what you’d see on other leading platforms. Binance employs a maker/taker fee structure, and fees vary based on trading volume and Binance Coin (BNB) balance. In general, higher volume trades are subject to lower fees.

Users can also get fee discounts for the following:

- Using Binance (BNB) coins in trades

- Referral bonuses

- Reaching very important person (VIP) status by trading a certain amount of assets

Binance users may also be subject to other fees. For a quick look at the different fees associated with various withdrawal and payment types, you can refer to the chart below.

| Payment Type | Fees |

|---|---|

| Wallet | N/A |

| Debit cards | 4.5% |

| ACH transfer | Free |

| Wire transfer | $15 for U.S. customers |

| Crypto conversion | N/A |

| Trades | 0.00% to 0.1% |

| Buy/Sell Crypto | 0.50% |

Security

Binance’s security features include two-factor authentication (2FA) via the Google Authenticator app or short message service (SMS), address whitelisting, device management, and the ability to restrict device access. The Binance.us platform also provides FDIC insurance on all U.S. dollar balances.

While these features can help keep user accounts relatively secure, Binance’s reputation remains a cause for concern. Overall their security offerings are about average for the industry.

Mobile Trading

A spot trade is a simple transaction between a buyer and a seller to trade at the current market rate, known as the spot price. The trade takes place immediately when the order is fulfilled.

Users can prepare spot trades in advance to trigger when a specific spot price is reached, known as a limit order. You can make spot trades with Binance on the Binance App.

Making a spot trade on the Binance App

1. Log in to the Binance App and click on [Trade] to go to the spot trading page.

2. You’ll now find yourself on the trading page interface.

(1). Market and Trading pairs

(2). Real-time market candlestick chart supported cryptocurrency trading pairs, and the “Buy Crypto” section

(3). Sell/Buy order book

(4). Buy/Sell Cryptocurrency

(5). Open orders

As an example, we will make a "Limit order" trade to buy BNB

(1). Input the spot price you wish to buy your BNB for and that will trigger the limit order. We have set this as 0.002 BTC per BNB.

(2). In the [Amount] field, input the amount of BNB you wish to purchase. You may also use the percentages underneath to select how much of your held BTC you want to use to buy BNB.

(3). Once the market price of BNB reaches 0.002 BTC, the limit order will trigger and complete. 1 BNB will be sent to your spot wallet.

You can follow the same steps to sell BNB or any other chosen cryptocurrency by selecting the [Sell] tab.

NOTE:

- The default order type is a limit order. If traders want to place an order as soon as possible, they may switch to [Market] Order. By choosing a market order, users can trade instantly at the current market price.

- If the market price of BNB/BTC is at 0.002, but you want to buy at a specific price, for example, 0.001, you can place a [Limit] order. When the market price reaches your set price, your placed order will be executed.

- The percentages shown below the BNB [Amount] field refer to the percentage amount of your held BTC you wish to trade for BNB. Pull the slider across to change the desired amount.

Opening an Account & Manager

To open a Binance account, follow the steps below:

- Step 1: Visit the Binance website

- Step 2: Click on the “Get Started” button in the top right-hand corner and enter the required information. The registration process can take a few minutes, as Binance will verify your account information.

- Step 3: Enable 2FA

- Step 4: Link your payment method

- Step 5: Deposit funds and start trading

Earning Category

Binance Earn offers a suite of products for you to grow your crypto holdings easily.

Flexible Savings, Launchpool, BNB Vault, and more opportunities are available on the platform. Binance will regularly launch high-quality products for Binance Earn, so make sure to check them out regularly.

How to use Binance Earn?

Log in to your Binance account and click [Finance] - [Binance Earn] to view all the products.

Currently, Binance Earn offers 2 types of earnings - Guaranteed and High Yield. Users can choose to invest their crypto in stablecoins for predictable returns, or high-yield staking coins that provide higher than average gains but with corresponding risks to your invested principal. Please only invest what you can afford to risk, regardless of how high the potential rates of return are.

1. Guaranteed

If you are new to crypto, you can get started with the products listed under [Guaranteed]. These products have relatively more stable yields and you can get back your principal after the locking period.

To search for crypto to invest, click on the drop-down menu to find your desired crypto, or click [Popular Coins] or [Best for Beginners] to see our suggested lists. Click [Search Coins] to search.

If you are looking for specific Binance Earn products, scroll down and click [View More] to enter the respective pages.

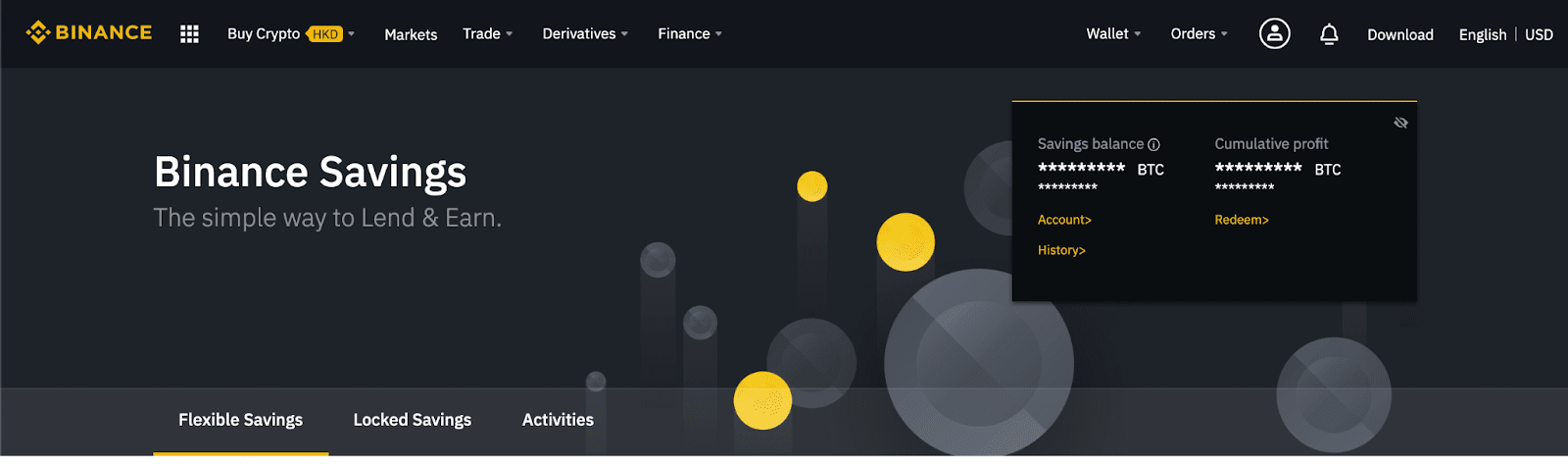

1.1 Savings

Savings offers two types of products - Flexible Savings and Fixed Savings. Similar to a bank's demand deposit, you can deposit your crypto and gain daily interest from your dormant funds.

Flexible Savings allows you to redeem your assets whenever you need, while Fixed Savings requires you to deposit your assets for a fixed period and in return, you earn a higher return than Flexible Savings. Please note that if you withdraw your funds in advance from Fixed Savings, you will also lose the interest gained.

Activities are high-yield staking opportunities offered jointly by Binance and various projects. You can lock the corresponding assets into the platform to obtain higher returns. Subscriptions will be closed once they reach the maximum limit. Please follow Binance Announcement for details on new Activities.

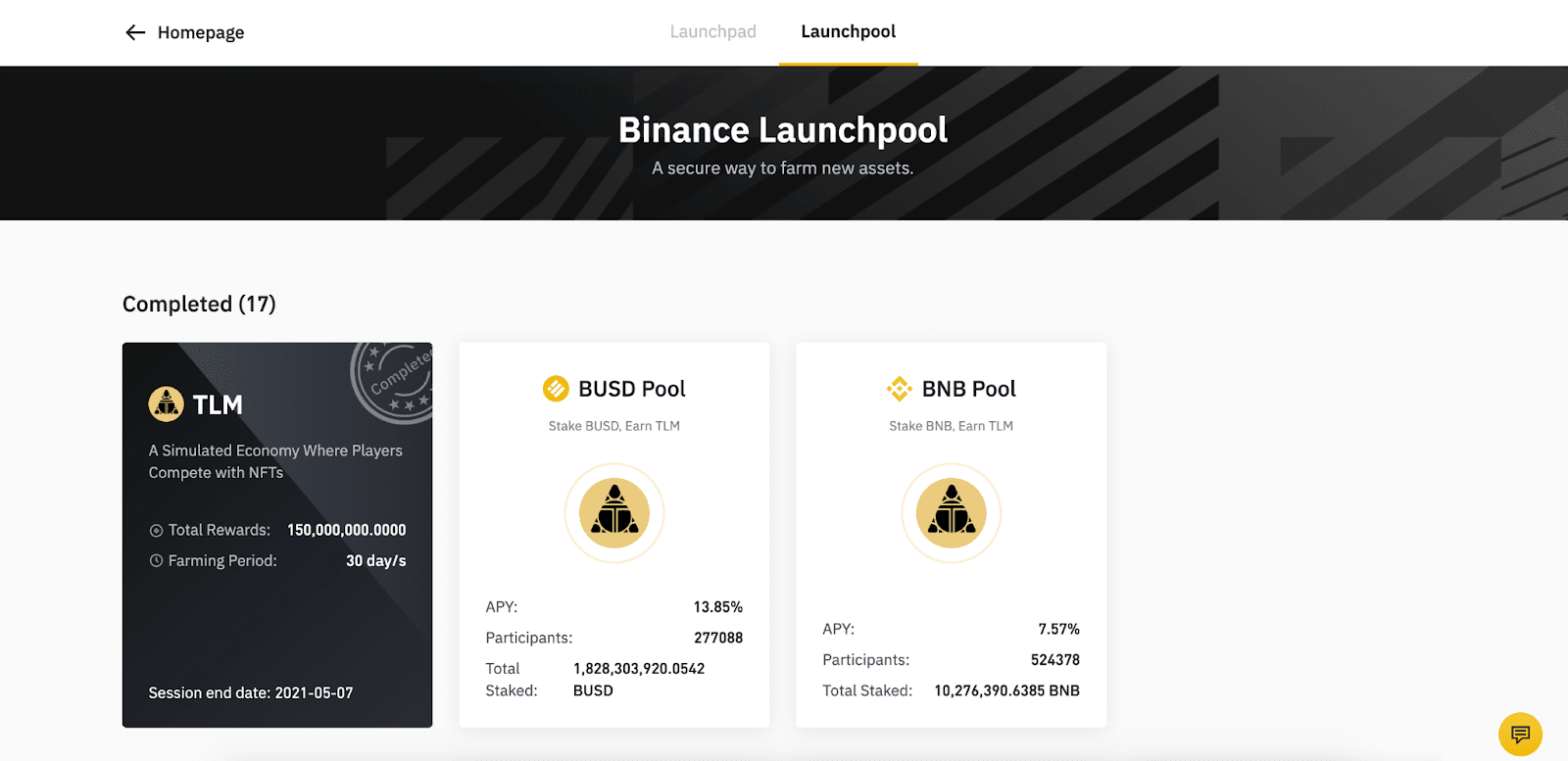

1.2 Launchpool

When users stake their crypto assets in DeFi projects, such as by providing liquidity to a liquidity pool, they will get rewards. By reinvesting these rewards, users can start a process known as Yield Farming.

Launchpool is the perfect option for users to farm new assets. You can acquire newly launched tokens as rewards when you stake BNB, BUSD, and other crypto assets. You can withdraw your deposited assets at any time, and rewards are distributed every hour.

1.3 BNB Vault

BNB Vault is a capital-guaranteed investment product to help you maximize the income potential of your BNB.

By investing in the Vault, BNB HODLers can easily invest in both centralized and decentralized finance products in just one easy step, with maximize yields and benefits from multiple opportunities available in the Binance ecosystem.

1.4 Locked Staking

You can gain rewards through Locked Staking by staking crypto assets on the blockchain. You can redeem these assets after you successfully subscribed, but please note that redemption requires a certain unlocking period. This locking period differs based on the product chosen.

1.5 ETH 2.0 Staking

Binance launched the ETH 2.0 Staking service to provide everyone with an accessible Ethereum 2.0 staking. Get started in a few clicks with just 0.1 ETH, and Binance will cover all validator operating expenses and bear the risk of on-chain penalties. All on-chain staking rewards will be distributed to users.

2. High Yield

Besides “Guaranteed”, Binance offers users a series of high yield products with relatively higher risks. Please DYOR before getting started.

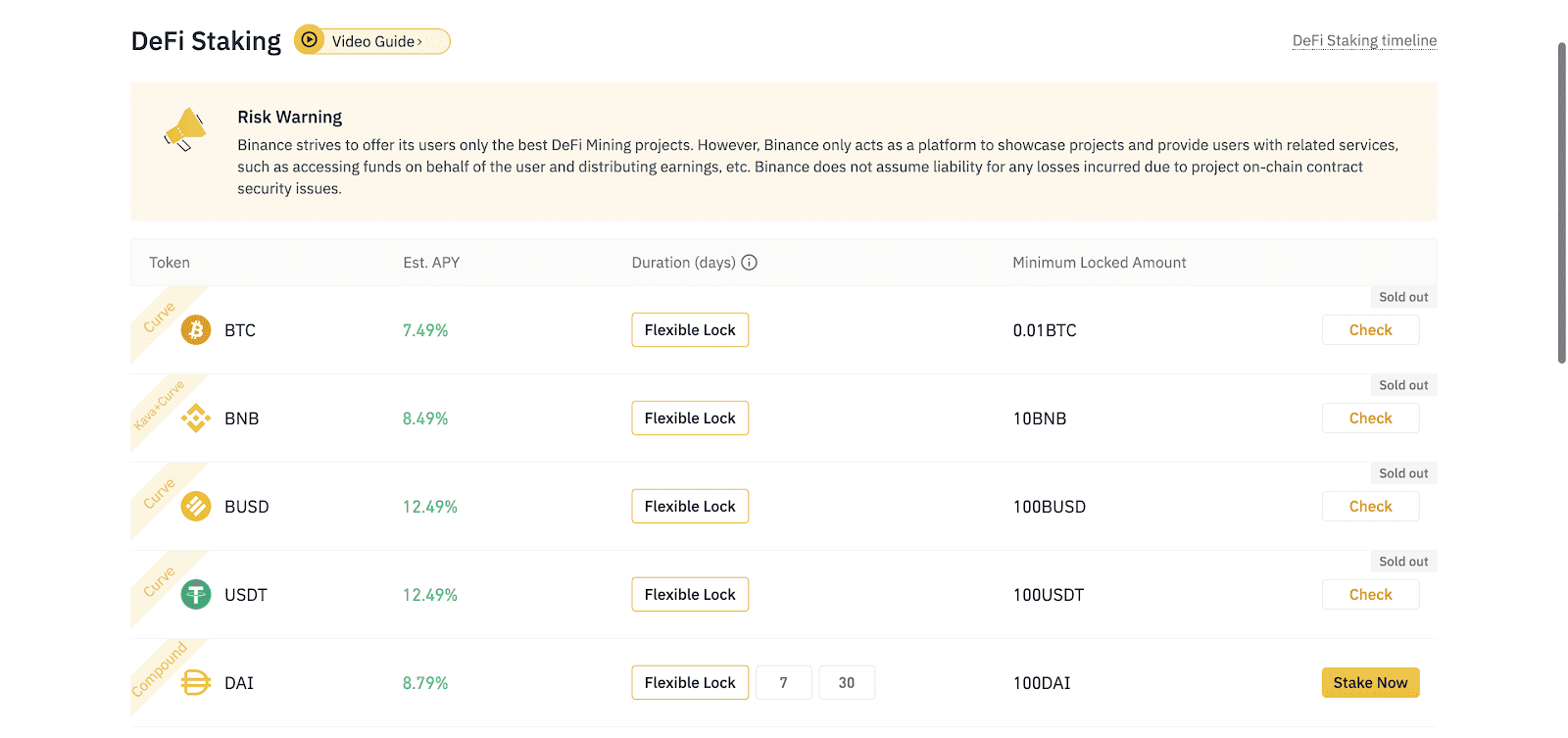

2.1 DeFi Staking

DeFi (Decentralized Finance) provides decentralized financial services through smart contracts on a blockchain. Binance introduced DeFi staking to help proxy users participate in related decentralized projects. You can now access the world of DeFi easily on Binance, without having the need to manage private keys, acquire resources, make trades, or perform other complicated tasks required for DeFi Staking participation. Earn the highest possible returns in the most simple and safest way.

Please note that DeFi products must be locked for a fixed period. If you need to withdraw your assets in advance, you may lose your corresponding rewards. Please read the product rules for more details before you participate.

2.2 Dual Investment

Dual Investment lets you deposit a single cryptocurrency and earn yield based on two assets. You can commit your crypto holdings and lock in a savings yield, but you will earn even more if the market price of their committed holdings increases. Dual Investment provides you with much more control over your risks.

The return on your savings will depend on how the crypto market has moved since the day you invested your crypto into Binance Dual Investment. When the product expires, you may choose to settle with one of the assets from the two options (such as BTC or BUSD). It offers non-guaranteed floating earnings, you can obtain the highest possible earnings while satisfying your digital asset risk management needs.

On the expiry date, the final settlement currency is determined by comparing the settlement price and the strike price. If the market price on your crypto holdings increases and your earnings exceed the savings rate, you’ll get the higher amount. If the market price on your crypto holdings dips or your earnings is below the savings rate, you’ll still get the yield from your savings. The bottom line is that your return will always be allocated to your benefit.

However, please note that your order cannot be redeemed in advance.

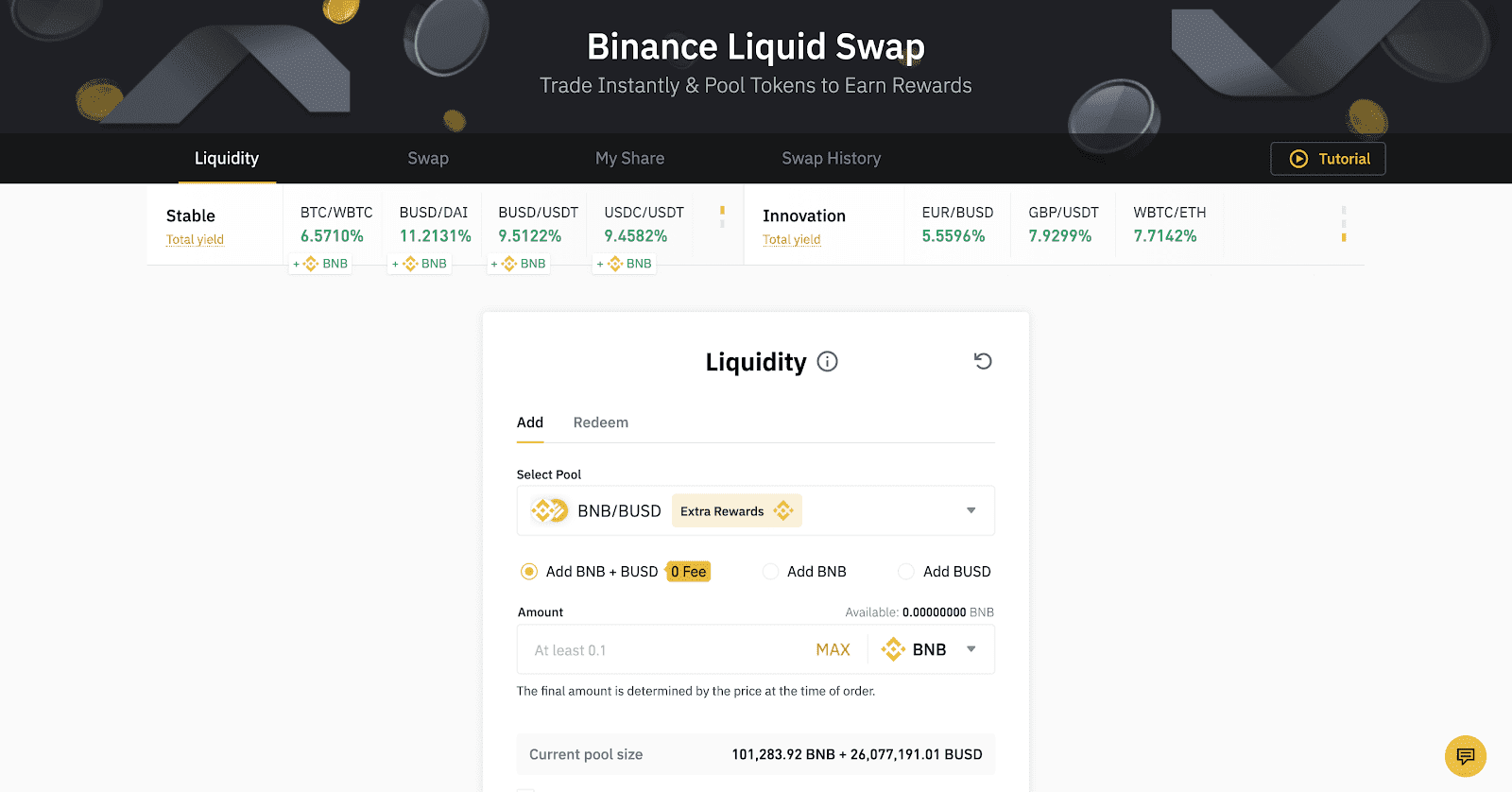

2.3 Binance Liquid Swap

Binance Liquid Swap embraces the principles of liquidity pools. It combines the advantages of centralized and decentralized financial services, allowing users to obtain high annual returns by providing liquidity to liquidity pools on Binance.

You can also swap cryptocurrencies in the liquidity pool and enjoy the benefits of low slippage and low handling fees, or remove assets at any time, but you will need to pay a handling fee if you swap only a single asset in the pool.

Trade Category

- Convert

- Spot

- Margin

- Futures

- P2p

- Strategy Trading

- Battle

- Fan Token

- NFT

- Swap Farming

- Convert

- Spot

- Margin

- Futures

- P2p

- Strategy Trading

- Battle

- Fan Token

- NFT

- Swap Farming

Gift & Campaign

- Referral

- Reward Center

- Task Center

- Live Giveaway

- Gift Card

Research & Education

Customer Support

Chat, Twitter, Submit a Ticket